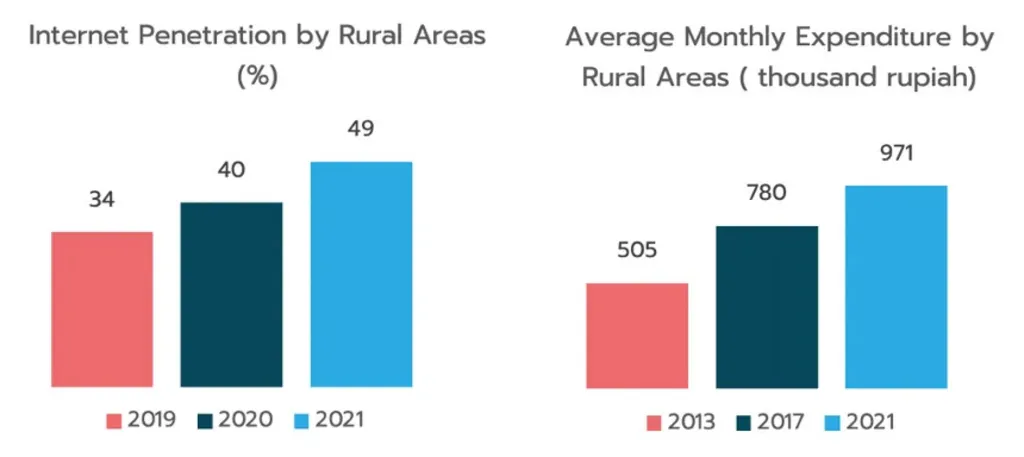

Indonesia’s digital transformation is advancing—but not evenly. While over 75% of urban residents have adequate internet access, only 45% of rural Indonesians can say the same. This stark divide means millions remain disconnected from digital tools that support education, business, and finance. The impact is significant. Without internet access, people in rural areas are often left behind in a fast-moving digital economy. From digital banking to e-commerce, the opportunities in Indonesia Rural Digital Inclusion are real. Yet, it's still out of reach for many.

Government Goals vs Ground Reality

The Indonesian government has a bold plan. By 2025, it aims to digitally empower all 75,265 villages across the country. The idea is to bring internet access, digital literacy, and digital services to every rural community. But as of late 2024, only 14,000 villages have used their village funds to launch any form of digitalisation program. That’s just 18% of the national target, despite large investments and policy focus.

The Rp71 trillion (US$4.5 billion) allocated for village development in 2025 includes major funding for digital infrastructure. Yet, implementation has been slow, often held back by weak infrastructure, limited skills, and low participation from local businesses.

Indonesia Rural Digital Inclusion: The Case of Rural SMEs

Small and medium-sized enterprises (SMEs) are a key part of the rural economy. But their ability to adopt digital tools is still limited. Just 30% of rural SMEs are effectively using digital technology. In contrast, 52% of urban SMEs are already on e-commerce platforms, compared to only 20% of rural SMEs.

This digital gap has real consequences. SMEs that have embraced digital tools saw a 40% increase in revenue over the past two years. That kind of growth could change lives in rural communities—if more businesses can access the same tools.

Indonesia Rural Digital Inclusion Is More Than Internet Access

Indonesia Rural Digital Inclusion is not only about connectivity. It's also about financial inclusion, digital literacy, and affordable tools. As of now, only 70.13% of rural Indonesians are financially included. The rest rely on informal services, which limits their access to mobile banking, online credit, and digital payment apps. Government programs like the Digital Village Program and the 100 Smart City Movement are working to close this gap. However, uptake has been low in rural regions, where training sessions often see limited SME participation.

Read Also: Understanding Fast Growth in Indonesia Digital Consumer Behavior

Private Sector and Infrastructure Investment

To succeed, public programs need private support. Telecom companies, fintech startups, and local digital service providers all have a role to play. With 97% 4G LTE and expanding 5G coverage, the infrastructure exists—but only if it reaches rural areas affordably. More partnerships between government and private players are needed to deploy solutions like community Wi-Fi, low-cost smartphones, and training workshops focused on digital tools for farmers, traders, and micro-entrepreneurs.

A Path Forward for Indonesia Rural Digital Inclusion

The need for Indonesia Rural Digital Inclusion is urgent—and the opportunity is enormous. Connecting the remaining 55% of rural Indonesians to the internet could unlock new income streams, improve education, and give access to life-changing services. With Rp71 trillion already on the table, and a national goal within reach, the next year will be critical. If the government can improve delivery, and if communities and businesses get involved, Indonesia could bridge its digital divide—village by village.

Read Also: Indonesia Infrastructure Development Plans: Current and Future Outlook