Indonesia’s aquaculture sector has expanded at an extraordinary pace over the past two decades. Production grew from about 994,000 metric tons in 2000 to 14.6 million metric tons in 2021. This equals an annual growth rate of 13.65%, much faster than both regional and global averages. By 2021, the Indonesia Aquaculture Output Rise accounted for 67% of the country’s total fisheries production, up from only 18.5% in 1990.

The industry now makes Indonesia the fourth-largest aquaculture producer in the world, holding an 11.59% share of global production. This success is powered by a diverse range of species, from red seaweeds and tilapia to catfish, marine shrimp, and prawns.

Indonesia Aquaculture Output Rise: Production Targets and Market Outlook

Projections show that Indonesia’s fish and seafood production, excluding aquatic plants, will reach about 7.07 million metric tons by 2030. In a more aggressive growth scenario, it could exceed 10.1 million metric tons, generating USD 39.5 billion in value and supporting nearly 8.9 million jobs.

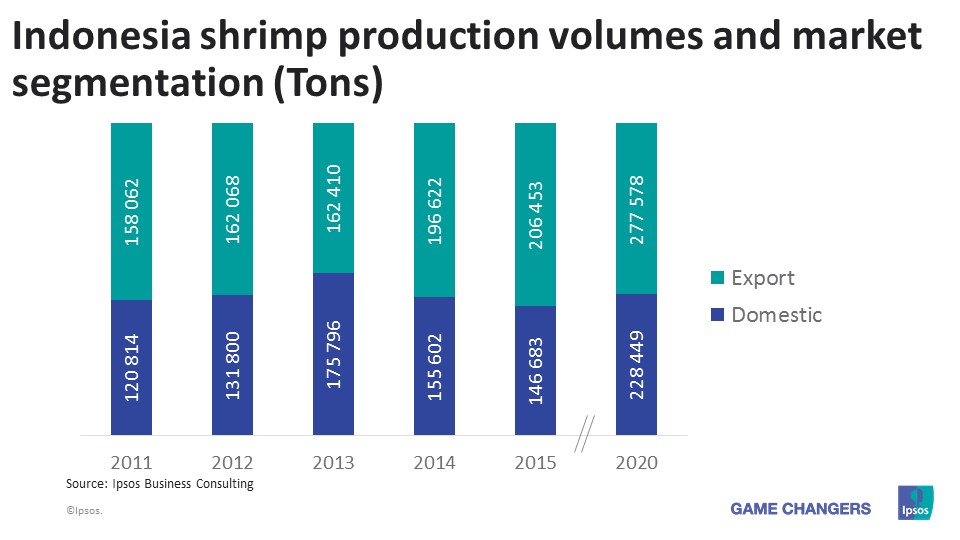

Government plans aim to produce 2 million metric tons of shrimp by 2024 through revitalizing shrimp ponds. These efforts are expected to push aquaculture past capture fisheries as the nation’s primary fish source before 2030.

The aquaculture market was valued at over USD 10 billion in 2022 and is projected to keep expanding through 2029. Rising population is also a driver, with domestic fish demand expected to increase by about 915,000 metric tons by 2030.

Sustainability at The Center of Expansion

Rapid growth creates challenges, especially in feed supply. Aquaculture feed demand is projected to grow by 71% in the coming years. Meeting this demand sustainably is crucial for both the economy and the environment.

The U.S. Soybean Export Council (USSEC) highlights the role of U.S. soybean meal as a sustainable and scalable feed ingredient. Soy provides high nutritional quality while reducing reliance on fishmeal, lowering environmental pressures on marine resources.

Innovation and Partnerships Driving Change

Collaboration between Indonesian stakeholders and U.S. partners is advancing sustainable practices. These include optimizing feed efficiency, improving water quality, managing disease, and enhancing biosecurity. Technology adoption and better traceability systems are also helping strengthen environmental stewardship.

Such measures not only boost productivity but also help protect marine ecosystems, ensure food security, and build resilience against climate and market disruptions.

Read Also: Chinese Reroutes & Indonesia Trade Diversion Effects

Indonesia Aquaculture Output Rise: A Balanced Path Forward

Indonesia’s aquaculture sector is already a global force. The challenge ahead is to sustain its growth without compromising natural resources. By aligning rising output with responsible feed sourcing, technological innovation, and strong partnerships, the country is well placed to meet its 2030 targets and remain a leader in the global aquaculture market.

FAQs

What is Indonesia’s aquaculture production forecast for 2030?

About 7.07 million metric tons for fish and seafood, excluding plants.Which species dominate Indonesia’s aquaculture sector?

Red seaweeds, tilapia, catfish, marine shrimp, and prawns.Why is sustainable feed important for Indonesia’s aquaculture?

Feed demand is expected to grow 71%, making sustainable sources key to reducing environmental impacts.What role does U.S. soybean meal play in the sector?

It provides a scalable, eco-friendly alternative to fishmeal for shrimp and fish farming.When will aquaculture surpass capture fisheries in Indonesia?

Likely before 2030, based on current government targets and growth rates.